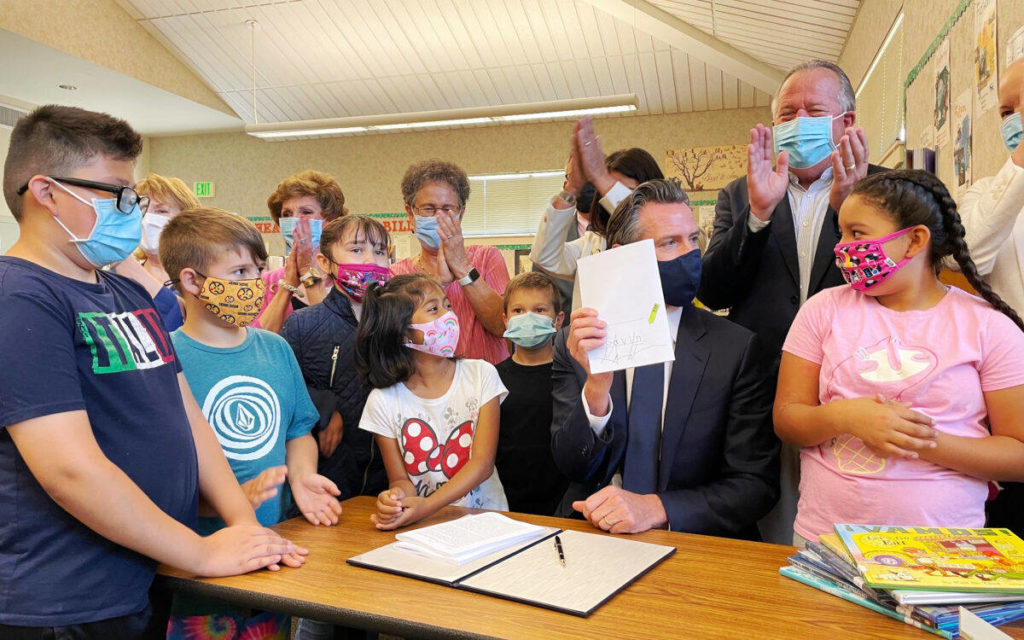

On July 12th, Governor Gavin Newsom signed the 2021-22 State Budget Act, a historic $262.6 billion spending plan fueled by a $76 billion state surplus and $27 billion in aid from the federal government. This state budget reflects an agreement and collaboration between the Governor and the Legislature after months of negotiations on how to invest an unprecedented amount of state and federal funding. As California continues to battle the ongoing pandemic and economic crisis, the approved budget will significantly aid millions of Californians being paid low wages, including those who have suffered job loss and are struggling to support themselves and their families, who continue to face housing and food insecurities, lack of child care support, and those who are seeking education and training to gain new skills and secure good jobs.

So far, this year has proven to be one of the most complex budgets in recent years. Although the state constitution requires the Legislature to pass a budget by June 15, it is not specific on how detailed it has to be once passed. Therefore, the Legislature passed a “placeholder” budget bill in June that authorized the state to spend significant funding without containing the details on how the funds would be invested, and then later introducing “Budget Bill Jr” measures that amended the original budget bill. The enacted budget signed on July 12 represents a concrete agreement between the Governor and Legislature on what exactly the spending plan will entail, including various trailer bills (many of which are still moving through the Legislature) that specifically contain provisions on program spending in areas such as higher education, economic recovery, and workforce training. We should expect to see more trailer bills acted upon once the Legislature resumes from summer recess on August 16.

This budget overview highlights investments that are intended to support higher education programs, workforce development strategies, broadband access for underserved communities, skills training, support services for working families, and financial assistance for California’s businesses – in addition to budget items that EDGE has been strongly advocating for throughout the year.

Investments in Higher Education, Students & Adult Learners

● Cradle-to-Career Data System: $18 million investment to establish for the first time in California, a statewide longitudinal data system – integrating K-12, higher education, social services, financial aid, workforce training, and employment data in a secure system – fully leveraging quality data to improve outcomes for all students and adult learners from “cradle to career.”

● Cal Grant Funding: $155 million to eliminate the age and time out of high school eligibility requirements for the Cal Grant entitlement program for community college students – providing access to an additional 133,000 students in the upcoming academic year. This new funding will be ongoing from the General Fund in 2021-22 and will grow to $332 million ongoing by 2025. Funding also includes an increased cap for the Students with Dependent Children award to accommodate new students in this program and adds an $82.3 million ongoing General Fund investment to support up to $6,000 in non-tuition support for each of these students. This investment prioritizes students and adult learners attending community colleges, many who come from communities of color. AB 1456 (Medina) continues to move forward in the legislature which also seeks to make significant reforms to the Cal Grant program.

● Cost of Living Adjustment (COLA) for Community Colleges: $371.2 million for a COLA of 5.07% and also pays down all of the deferrals from 2020-21. This is a critical investment as colleges continue to navigate an unpredictable year.

● COLA for the CA Adult Education Program: $12.5 million ongoing increase for a 4.05% COLA, in addition to $1 million ongoing Prop 98 General Fund to provide technical assistance to adult education regional consortia. The budget also authorizes the CA Department of Education and the Community College Chancellor’s Office to collaborate on distributing adult education funding to program sites in a more timely manner.

● Competency-Based Education (CBE): $10 million one-time Prop 98 funding to create a workgroup that will develop recommendations to support competency-based education, in addition to implementing a CBE pilot. This has been an ongoing priority for EDGE – to ensure California offers more flexible postsecondary learning approaches, enabling Californians to participate in postsecondary education and achieve marketable skills and credentials.

● Dreamer Resource Liaisons: an increase of $5.8 million ongoing Prop 98 funding to further support Dreamer Resource Liaisons and student support services for immigrant students, including undocumented students attending community colleges.

● CC Strong Workforce Program: an increase of approximately $42.2 million ongoing Prop 98 General Fund to support the SWP, and up to 10 percent of those funds can be used to expand work-based learning opportunities in 2021-22.

Investments to Support Social Safety Net Resources for Working Families

● Child Care Services: increases child care access by 200,000 slots – 120,000 in 2021-22 and phasing in an additional 80,000 over the next four years – in the following programs: Alternative Payment, General Child Care, Migrant Child Care, bridge program for foster children, and prioritizes ongoing vouchers for essential workers currently receiving short-term child care.

● Food for All: the budget approves the “Food for All” initiative, which lays the groundwork to expand the California Food Assistance Program (CFAP) to provide state-funded nutrition benefits to those ineligible for CalFresh or CFAP due to immigration status. A decision about the specific population that will be served with these resources will be made closer to the implementation date, subject to appropriation in the 2023 Budget; this investment allows for readiness in anticipation of that decision. The funding plan is as follows: $5 million General Fund to expand CFAP in 2021-22, $25 million General Fund in 2022-23, $280 million General Fund in 2023-24, and subject to appropriation of $280 million General Fund in 2024-25 and on-going. Additionally, the budget provides close to $300 million one-time to support food banks across the state. SB 464 (Hurtado) and AB 221 (Santiago) are also moving through the legislature which aim to address food insecurities for working families.

● Rent and Utility Relief: AB 832 (Chiu) was signed in late June, extending the rent moratorium until September 30, 2021, and expanding the Rent Relief Program to provide up to 100 percent in assistance for rental and utility payments. AB 832 will allow the state to maximize the $5.2 billion federal funds for rental, utilities, and housing-related expenses in order to assist Californians hit hardest by the pandemic.

● Student Basic Needs: $100 million one-time Prop 98 General Fund available over three years to address student basic needs such as food, child care, and housing insecurity. Also provides $30 million ongoing Prop 98 General Fund to support student mental health services, and $30 million ongoing Prop 98 General Fund for colleges to establish basic needs centers and hire basic needs coordinators.

● Community College Student Support Programs: COLA adjustments approved for the following community college categorical programs: Extended Opportunity Programs and Services, campus child care, CalWORKs, Disabled Students Program and Services, child nutrition and mandates block grant.

● Universal Basic Income: $35 million one-time General Fund (over 5 years) to establish a Universal Basic Income pilot program intended to support low-income Californians. These programs would be administered by cities or counties, and require a local-match commitment, and ensure low-income Californians receive this financial support.

● Golden State Stimulus II: Golden State Stimulus II builds on the relief provided under the Golden State Stimulus I earlier this year by providing a tax rebate payment for financial relief for low and middle-income Californians who were affected by COVID-19. The trailer bill, SB 139, authorizes payments ranging from $500 to $1,100 depending on eligibility. Additionally, the trailer bill provides a filing extension for individual tax identification number (ITIN) filers who have applied for their ITIN but have not yet received it. Those that qualify have until February 15, 2022, to file and collect both Golden State Stimulus I and II. In total, the budget provides $8.1 billion in relief to low and middle-income individuals – immigrant families who file taxes with an ITIN will be eligible to receive $1,000.

Investments in Workforce Development

● High Road Training Partnerships (HRTP): $100 million one-time General Fund to fund additional High Road Training Partnership (HRTP) programs. These training partnerships up-skill the current workforce while creating pathways for new hires and prioritize workers from underserved communities.

● Breaking Barriers to Employment Initiative: $30 million one-time General Fund to continue funding the Breaking Barriers to Employment program, which assists individuals who face systemic barriers to employment in obtaining the skills necessary to prepare for work in high-demand industries. AB 628 (E.Garcia) continues to move through the Legislature, which seeks to expand the program by providing access and eligibility for community-based organizations to supply training and supportive services.

● Community Economic Resilience Fund: $600 million one-time federal funds to create the Community Economic Resilience Fund (Fund). The Fund will provide financial support to regional stakeholder collaboratives to plan and implement region and industry-specific economic strategies, with a specific focus on supporting high road jobs. These collaboratives will include community capacity-building programs, which will support broad participation in planning and decision-making. This investment builds upon legislation, AB106 (Salas) Regions Rise Grant Program, which seeks to support innovative strategies that address regional workforce needs involving labor, community-based organizations, and private and civic organizations to achieve economic prosperity.

● Employment Training Panel (ETP): $50 million one-time General Fund for the ETP to support training opportunities for new and incumbent workers and address skills gaps in economically underserved regions. These resources will allow the ETP program to expand training resources in the health care, information technology, and advanced manufacturing industries. The budget also provides an additional $15 million to ETP to align and operate programs with the community college system in partnership with the Strong Workforce Program.

Investments in Broadband Access for All

- The budget includes a $6 billion investment to expand broadband infrastructure and enhance internet access for unserved and underserved communities across the state. This historic investment will advance the state’s commitment to bridging the digital divide by building the needed infrastructure, connecting millions of students, working families, and businesses with quality high-speed internet. EDGE is proud to have joined in collaboration with various stakeholder partners advocating on this critical investment, including local governments, schools, hospitals, businesses, labor, civil rights, upward mobility, and higher education advocates. The broadband package also includes grant funding for digital literacy training programs for low-income communities facing socioeconomic barriers to broadband adoption.

Investments to Support CA’s Businesses & the Economy

- CA Dream Fund: $35 million one-time General Fund proposal to support micro-grants up to $10,000 to seed entrepreneurship and small business creation for underserved populations that are facing opportunity gaps.

- CA Infrastructure and Economic Development Bank (IBank): $20 million one-time General Fund for IBank’s Small Business Loan Guarantee Program to continue to provide loans as businesses recover from the economic impacts of the COVID-19 Pandemic.

- Small Business COVID-19 Relief Grant Program: expands relief to small businesses by adding $1.5 billion to the state’s earlier $2.5 billion investment in the Small Business COVID-19 Relief Grant Program, which has helped approximately 210,000 businesses stay open and keep Californians employed.

- Homeless Hiring Tax Credit: the budget creates the Homeless Hiring Tax credit for eligible employers that hire employees who are experiencing homelessness in California.

Other Noteworthy Investments in Workforce Development

● Golden State Education and Training Program: $500 million ($473 federal funds and $27.5 GF) to establish the Golden State Education and Training Program, which will award grants to displaced workers seeking to attend a community college, CSU, or UC.

● Regional K-16 Education Collaboratives: $250 million one-time grant funding to support regional K-16 collaboratives focused on streamlining educational pathways leading to in-demand jobs.

● California Apprenticeship Initiative: $15 million ongoing Prop 98 General Fund to, including an increased COLA of 4.05%.

● Social Entrepreneurs for Economic Development (SEED): $20 million one-time General Fund for Workforce Boards to continue the Social Entrepreneurs for Economic Development program, which provides grants to community-based organizations to provide training and micro-grants to help marginalized communities start or maintain a small business that addresses a social problem or meets community needs. EDGE also supported this investment in the 2020-21 budget process.

● Prison to Employment Program: $20 million one-time General Fund to extend and expand the Prison to Employment program, which strengthens the pathways for justice-involved individuals to the labor force.

● Housing Apprenticeships: $10 million one-time General Fund to support pathways for workers from underserved communities to state-approved apprenticeships in the trades, with a focus on affordable housing construction. These programs are intended to build upon the High Road Construction Careers (HRCC) partnerships among local workforce boards, local building trades, community organizations, community colleges, construction contractors, and other entities.

● Labor Market Data: $10 million one-time General Fund to improve data outcomes between the labor market and the community colleges. This infrastructure will simplify collaboration and provide job outcome data.

● Song-Brown Health Care Workforce Training Program: $50 million General Fund one-time (over six years) for additional awards to support and sustain new primary care residency programs through the Song-Brown Health Care Workforce Training Program.

● Community Colleges & State Workforce Program Collaboration: $75 million one-time General Fund to foster new cooperative efforts between the state’s workforce programs and the community colleges. The community colleges will receive $20 million to implement these efforts.

○ $25 million one-time General Fund for the CA Workforce Board to create or expand industry-based and worker-focused High Road Training Partnerships connected with community college programs.

○ $25 million one-time General Fund for the CA Workforce Board to fund regional equity and recovery partnerships between regional community college consortia and local workforce boards.

As we approach the final months of the budget season, it is important to note that a lot of these critical investments are either one-time dollars and/or will be phased in over several years. And although California was fortunate to have such a big state surplus and assistance from the federal government, it is unclear what the future will hold for the state budget and economy, and the countless support programs that so many underserved populations rely on. As mentioned, although the budget has been signed by the Governor, we should expect to see various budget trailer bills be negotiated between the Governor and Legislature in the remaining months of session, including the higher education trailer bill AB 132 which is currently pending before the Governor.

EDGE remains committed to elevating strategies to advance workforce development policies that address workforce shortages and create pathways to the middle class for all Californians. Moving forward, EDGE will remain actively engaged as budget and bill discussions continue leading up to the September 10th end-of-session deadline.

Update: On July 27th, Governor Newsom signed AB 132, the higher education budget trailer bill.